The Main Principles Of Offshore Trust Services

Wiki Article

Some Of Offshore Trust Services

Table of ContentsThe 10-Second Trick For Offshore Trust ServicesOffshore Trust Services for DummiesThe Buzz on Offshore Trust ServicesThe Buzz on Offshore Trust ServicesThe Best Guide To Offshore Trust ServicesOffshore Trust Services for Dummies

, the count on deed will information exactly how the international trustee need to utilize the count on's assets.This post will talk about overseas trust companies, how they work, as well as just how to select one for your overseas count on. Offshore depends on offer a practical ways of transferring as well as securing possessions. Nonetheless, the Internal Revenue Solution has raised monitoring of offshore count on recent years, as well as conventional tax obligation legislations still use.

A Biased View of Offshore Trust Services

Costly trustee fees can cause your overseas possession protection worth to decrease with time, clearing up fees a requirement for a high quality count on firm. In the web age, it's easy to find consumer testimonials on any given business. Reviews alone might not guide your choice, however reviewing previous customers' experiences might assist you outline concerns to ask possible trustees and also contrast business.Numerous lawful entities offer their clients property security services, yet the high quality of a possible trustee will certainly depend on their experience with numerous sorts of counts on. Somebody that desires to develop a small family trust fund will certainly have various legal requirements than someone looking for investment opportunities. It would certainly be best if you located a trustee that can fulfill the expectations for trust monitoring according to your goals.

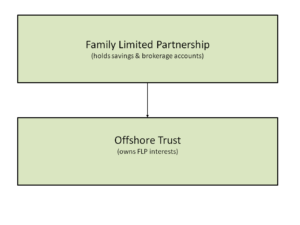

An is a legal tool that enables an individual to safely protect their possessions from lenders. An offshore trust fund works by moving ownership of the assets to a foreign trustee outside the jurisdiction of U.S. courts. While not required, usually the overseas depend on only holds properties located outside of the USA.

The Only Guide for Offshore Trust Services

Chef Islands depends on can be made to secure all trust assets from U.S. civil financial institutions. The trustmaker selects a trustee that is either an individual resident of an international nation or a count on firm with no United stateThe trust must mention that the place of the trust (called the situs) controls depend on arrangements.

Indicators on Offshore Trust Services You Should Know

Removes your properties from oversight of state courts. Enables you to disperse your assets effectively upon your death.

realty in the name of an overseas trust or an overseas LLC, an U.S. court will still have territory over the click for more info borrower's equity and the residential or commercial property title because the residential property remains within the U.S. court's geographical jurisdiction. Offshore planning might shield U.S. building if the home is overloaded by a home loan to an overseas financial institution.

The Offshore Trust Services PDFs

banks. A possible borrower can borrow funds from an offshore bank, hold the funds offshore in a CD, and also secure the finance with a lien on the home. The CD rate of interest would certainly cover a lot of the finance expense. The lending proceeds may be held at a United state financial institution that is immune from garnishment, albeit gaining reduced interest rates however with even more practical accessibility to the money.A count on protector can be given the power to transform trustees, reallocate advantageous passions, or guide the financial investment of trust possessions. Advisors might be international or United state persons that have the authority to guide the financial investment of count on assets. An overseas count on protects a United state debtor's possessions from U.S. civil judgments largely due to that site the fact that the trust fund's properties and also its trustee are located past the lawful reach of U.S.

U.S. judges have courts authority to compel an offshore trustee to take any action any type of trust assetsCount on

Chef Islands trust firms are respectable, experienced, and also thoroughly experienced. The other Cook Islands are well-regarded as the premier place to establish up an overseas depend on. As one of the original nations with beneficial offshore trust regulations, the Chef Islands have al lengthy background of court choices maintaining the defense managed by its depends on.

Report this wiki page